The AI (ChatGPT) Stock Investing Handbook: Price Bubbles End Badly

Here is the response from ChatGPT for the prompt internet stock market bubble entered on January 9, 2023

The internet stock market bubble was a period of rapid growth and speculation in the technology sector, specifically in companies that were involved in the development and commercialization of the internet. The bubble began to form in the late 1990s and reached its peak in 2000.

The internet stock market bubble was characterized by the rapid rise in valuations of internet-based companies and a corresponding increase in investment in these companies. Many of these companies were able to raise significant amounts of capital through initial public offerings (IPOs) and other funding methods, and their stock prices soared.

However, the internet stock market bubble was ultimately unsustainable, and many of the companies that had benefited from the bubble experienced significant declines in value as it burst. The bubble began to burst in early 2000, and by 2002, many of the companies that had gone public during the bubble had gone bankrupt or seen their stock prices decline significantly.

The internet stock market bubble had significant consequences for investors, as many of them experienced significant losses as a result of the decline in stock prices. It is often cited as a cautionary tale of the dangers of speculative bubbles and the importance of careful investing

Everyting Bubble

Here is the response from ChatGPT for the prompt everything bubble entered on January 9, 2023

The term "everything bubble" is used to describe a hypothetical scenario in which asset prices across all asset classes are inflated to unsustainable levels and are at risk of collapsing. Some people believe that we are currently in an everything bubble, as asset prices in a variety of sectors, such as stocks, real estate, and even collectibles, have reached all-time highs.

The everything bubble is often compared to the dot-com bubble of the late 1990s and the housing bubble of the mid-2000s, both of which were characterized by rapid price appreciation and a corresponding increase in investment, followed by a sharp correction as the bubbles burst.

There are several factors that could contribute to the formation of an everything bubble, including low interest rates, a surplus of liquidity in the financial system, and investor exuberance. Some experts believe that the everything bubble could be fueled by the current low-yield environment, which is driving investors to seek higher returns in riskier asset classes.

It is important to note that the concept of an everything bubble is highly speculative, and it is not clear whether or not such a bubble actually exists. It is always important for investors to carefully assess the risks and potential returns of any investment and to diversify their portfolios to mitigate the impact of market fluctuations.

Housing Bubble

Here is the response from ChatGPT for the prompt housing bubble entered on January 9, 2023

A housing bubble is a period of rapid appreciation in the value of real estate, followed by a sharp correction as the bubble bursts. Housing bubbles are often characterized by a surge in demand for housing, coupled with a limited supply of homes for sale. This can cause prices to rise rapidly, leading to speculation and overvaluation of the market.

Housing bubbles can have significant consequences for homeowners, as well as for the economy as a whole. When a housing bubble bursts, it can lead to a decline in home values, which can result in negative equity (when the value of a home is less than the amount of mortgage debt outstanding) and increased foreclosures. This can have a ripple effect on the economy, as it can lead to a decrease in consumer spending and a decline in overall economic activity.

The housing bubble of the mid-2000s, also known as the subprime mortgage crisis, was a significant event in financial history that had far-reaching consequences. It was triggered by a variety of factors, including lax lending standards, the proliferation of adjustable rate mortgages, and a lack of regulation in the financial system. The housing bubble burst in 2007, leading to a decline in home values, a surge in foreclosures, and a significant impact on the global economy.

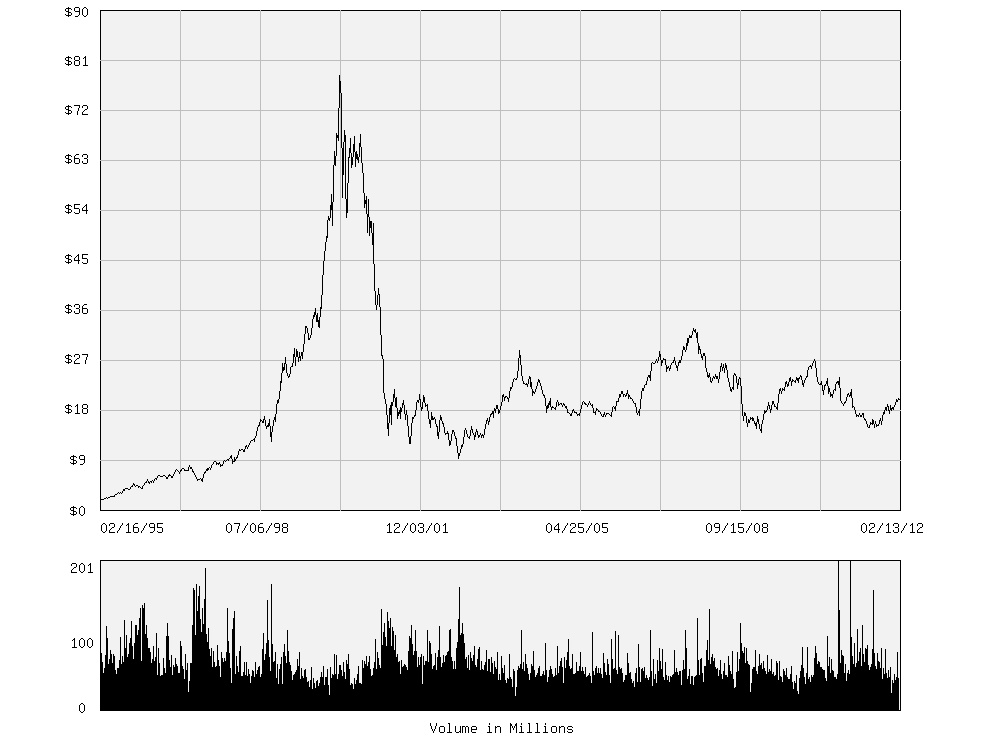

Double Bottom Chart - Not from ChatGPT

Previous Article

Table of Contents

Next Article

Own Stocks Get Started Dividends Retirement Buy Sell Hold Stock Portfolios ETFs Mutual Funds Cautions Indexes Price Patterns Options Econ

S&P 500 Investing Guide ESG Investing Guide Dividend Handbook Bond Investing Handbook Crypto as a Scam (CryaaS) Crypto Horror Stories Stock Investing Stories #1-#54

buyupside.com